Western Colorado Real Estate Trends & Market Update

End of 2023 into 2024

There’s been significant talk in the real estate world about the local markets returning to the “normalcy” seen prior to 2019 and the Covid Pandemic years. To pull the US economy from a downward spiral, the Fed reduced interest rates to historic lows, where almost every consumer in the country holding a mortgage, not to mention consumers looking to purchase real estate, took the opportunity to re-finance their loan or purchase with low rates. The cheap cost of money incentivized consumers, creating intense competition sometimes leading to multiple offers over asking price for properties. Real estate values surged, with some areas in Western Colorado almost doubling in pricing since the pre-pandemic values of 2019.

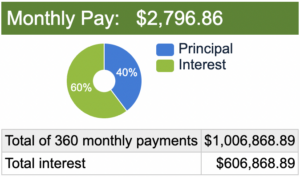

As the economy strengthened, inflation became a widespread financial issue, and the Fed hiked interest rates through the majority of 2023, up to almost 8% for most traditional 30-year mortgages. The goal was to cool the economy and inflation. This had an interesting effect in two ways. Now, everyone that had real estate mortgages that locked in at low rates in the 2 and 3% range are unwilling to sell, knowing the cost to purchase and finance a new home is significantly more. For example, if a consumer purchased a $400,000 home with 20% down for 30 years in 2019 at a 3% rate, the monthly mortgage cost would be around $1,300/month.

The same property in 2023 would likely now range in the $500,000+ range, with 20% down, 30 year mortgage, and at the average mortgage cost of 7.5%, that monthly mortgage cost would now be $2,796/month.

What happens next? If these real estate owners were thinking of selling but need to sell their current home to transition into a new home, the trouble of such low inventory on the market makes finding a replacement property almost impossible. In turn, many buyers won’t bring their property to market until they find a replacement property, further quenching the supply problem we’re facing.

This low inventory coupled with still relatively strong market activity is keeping real estate values very close to where their peak was with the low interest rates during Covid.

The common trend we’re seeing is properties may not aggressively increase in value like we saw over the past 4 years, but values have plateaued, staying relatively flat and slowly trending upward as interest rates continue to drop and more buyers enter the buying market.

Construction

Low inventory, increasing demand, and high replacement costs are factors that are leading us in the direction of development and construction. With many buyers unable to find replacement properties, many consumers are now opting to build. Thankfully material costs, labor shortages, and price-gouging on contract work has subsided. Many neighborhoods and rural areas with undeveloped lots are seeing activity we haven’t seen for years.

Most existing homes will sell anywhere from the $200/ft up to $300/ft range in Western Colorado depending on the location, acreage size, finishes, and customizations of the property. Construction of a new home not including the land costs will typically run a consumer $240/ft for an experienced builder to provide a home with mid-level finishes. Granite counter tops, lifeproof faux wood floors, carpeted bedrooms, basic trim, tiled bathrooms. In many cases, it makes more sense to a buyer to build a brand new home for comparatively the same price of an existing, dated property.

Market Moving Forward

As we progress further into 2024 two key factors will predicate the strength of the real estate market. Interest rates and inventory. If rates (as predicted) drop below 6%, it’s anticipated that buyer interest will soar by over 70% for homes. In turn, more sellers may be willing to enter the market to sell their homes and find a replacement property. With a surge of activity like this, new construction will continue to fill the void for buyer interest, and real estate prices will remain strong. With this outlook, we’re seeing increased activity from savvy investors looking to get ahead of the curve. Low cash offers to overpriced listings, investment into land, development of properties to create inventory, and long-term land banking are trends we continue to see on a daily basis.

In short, finding the right property can be a complex and difficult process, but there’s never been a bad time to own real estate.

Jake Hubbell, ALC